Clean Energy Investment and Capacity: Canada Has Its Best Year Ever

Other nations may be growing their clean energy sectors at a faster clip, but Canadians still have a lot to celebrate. When it comes to investment and boosted capacity, we just had a banner year.

In its report Tracking the Energy Revolution — Global 2015, Clean Energy Canada notes that Canada was trailing other nations in the global market for clean energy products and services.

That’s the bad news,says Clean Energy Canada. The good news is the home front looks fantastic. Here’s how the picture looks for both investment and capacity. With respect to domestic clean energy investment and development, this past year proved Canada’s best ever.

Though our domestic clean tech sector grew 17% in 2013, our slice of the global pie narrowed as other nations shored up their clean industries with more substantial policy.

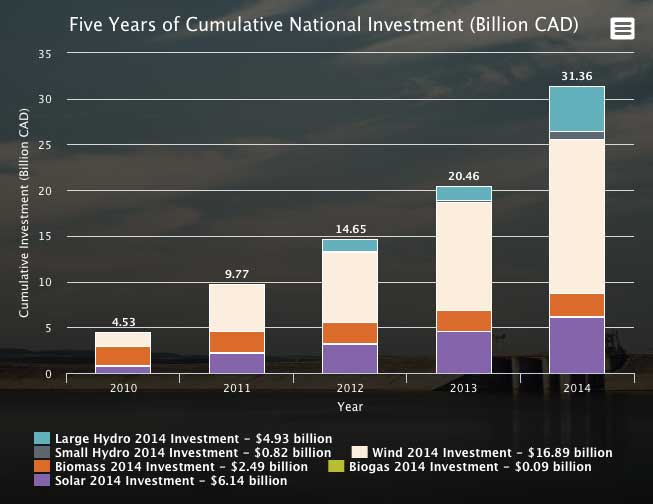

Investment

In 2014, Canada ranked sixth in the world for investment in new domestic clean energy generation projects. The final number came in at $10 billion, as our nation maintained its standing from the previous year. And while we didn’t move up the global ranks, dollars flowing into clean-energy generation jumped a significant 88% over the previous year.

Crack open the spreadsheets, and a number of significant projects and deals underlie that increase. Here are three:

• Calgary’s BluEarth Renewables raised $81 million of equity financing, bringing its total amount of money raised to $250 million since it incorporated in 2010. The cash will support a range of small-hydro, solar, and wind projects.

• Pattern Energy, Samsung Renewable Energy and Capital Power Corporation landed $850 million for the since-completed K2 wind complex in the Township of Ashfield-Colborne-Wawanosh, due west of Toronto on Lake Huron.

• Nova Scotia Power, Minas Basin Pulp & Power, and Oxford Frozen Foods financed the development of 102 MW Parker Mountain Community wind farm totalling $200 million.

Though the federal government is AWOL on the file, numerous Canadian provinces are putting out the welcome mat for banks by sending policy signals that they are open for business in the low-carbon economy.

Each year, consulting giant Ernst & Young ranks 40 economies on how attractive they are to renewable-energy investorsbased on a wide range of considerations, such as political support and stability of power grids. On this front, this past year, Canada’s rank remained unchanged at seven, behind China, the United States, Germany, India, and Japan.

When it comes to fostering a business climate of clean-tech innovation, Canada is punching above its weight. Despite a lack of strong supportive federal policies, the Global Cleantech Group and the WWF also ranked Canada seventh out of 40 economies—ahead of established cleantech leaders Germany and Japan. There’s general innovation support and that pulls up Canada’s ranking, but we’re not keeping pace on cleantech-specific drivers, and that shows in a lower ranking on commercialization.

As a final note: As we saw last year, Canadian companies are also playing a leading role as deal brokers for clean energy projects beyond our borders. The best example of this is Toronto’s Northland Power. In 2014 the firm inked a power purchase agreement with Dutch utility Delta for its 600 MW offshore wind farm in the Netherlands, after securing almost $5.2 billion for the project. This was then, and remains today, the largest non-hydro renewable energy placement ever.

Capacity

When it comes to renewable electricity, Canada’s up there with the big players. Largely as a result of our extensive and large hydropower facilities, as of the end of 2014, our plants boast a collective capacity of 89 GW. That places us 4th in the world for our ability to produce pollution-free power.

Here’s how that breaks down, by technology. Note the growth in wind and solar atop a strong hydro foundation.

Coal’s flagging dynasty

In the past five years, largely thanks to policy leadership in Ontario, Canadian utilities have shut down 4,600 MW worth of coal power plants. That’s the equivalent of taking 8.7 million vehicles off the nation’s roads.

Source: Tracking The Energy Revolution / Canada 2015, Clean Energy Canada, http://cleanenergycanada.org/trackingtherevolution-canada/2015/#/investment-and-capacity.

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 10 – Grounding and Bonding](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)