Economic Impact of COVID-19 on Canadian Businesses Across Firm Size Classes

Aug 30, 2020

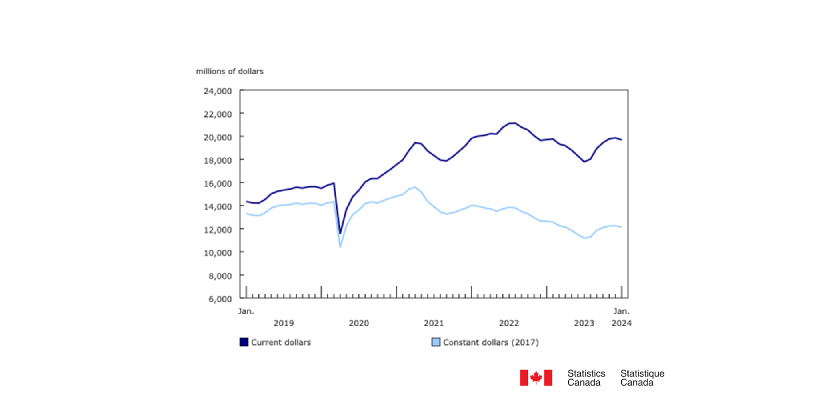

According to a new study published by Statistics Canada, small firms experienced larger decreases in economic activity than large firms in the quarter coinciding with the onset of the COVID-19 pandemic.

The study, titled Economic Impact of the COVID-19 Pandemic on Canadian Businesses across Firm Size Classes, compares two measures of economic activity across small (0 to 99 employees), medium-sized (100 to 499 employees) and large (500 or more employees) firms. These measures are actual hours worked by employees in production and real gross domestic product (GDP). The measures decreased overall across all firms, but small firms — particularly those in the services sector — were among the hardest hit.

The COVID-19 pandemic has the potential to decrease economic activity through related government interventions, such as the closure of non-essential businesses and travel restrictions, as well as through a decrease in demand. Small and even medium-sized firms may experience relatively larger decreases in activity because the pandemic has particularly severe impacts in industries where smaller businesses tend to be concentrated and in firms where physical proximity is required, such as in the tourism, transportation, restaurant, accommodation, and arts and entertainment sectors.

From 2016 to 2019, firms in all size classes experienced positive growth in annual average hours worked. In contrast, in the first quarter of 2020, hours worked decreased by 9.4% in small firms and 11.1% in medium-sized firms. Hours worked increased by 1.2% in large firms, but this growth was smaller than that from 2016 to 2019. In the first quarter of 2020, hours worked declined by 5.6% in the business sector.

Similarly, real GDP increased for all firm size classes from 2016 to 2019, but then declined in the first quarter of 2020. The largest decrease was in small firms (-2.1%), followed by large (-1.5%) and medium-sized (-1.1%) firms. Overall, real output declined by 1.7% in the business sector in the first quarter of 2020.

Hours worked and real GDP declined in the first quarter of 2020 in both the goods and the services sectors. In both sectors, the declines in hours worked were larger among small and medium-sized firms. In contrast, hours worked in large firms in the services sector increased by 2.8% in the first quarter of 2020.

In the services sector, the decline in real GDP was also larger among small and medium-sized firms. In contrast, in the goods sector, the decline in real GDP was most pronounced among large firms.

Source: Statistics Canada, www150.statcan.gc.ca/n1/daily-quotidien/200819/dq200819c-eng.htm

![Guide to the Canadian Electrical Code, Part 1[i], 26th Edition – A Road Map: Section 10 – Grounding and Bonding](https://electricalindustry.ca/wp-content/uploads/2022/11/Guide-CE-Code-2.png)